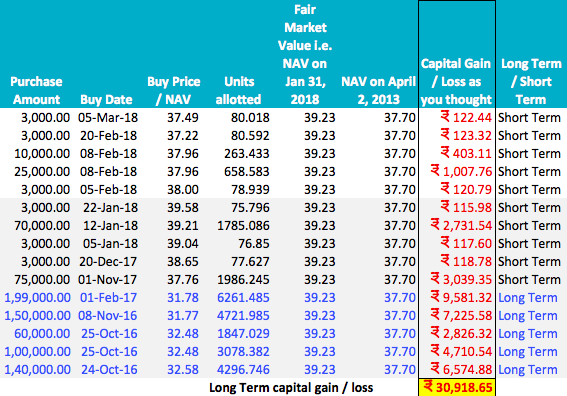

ET Money on X: "Now, let's discuss short-term capital gains. You cannot use the tax harvesting strategy on STCG Why?🤔 Because STCGs incur a flat 15% tax But you can use the

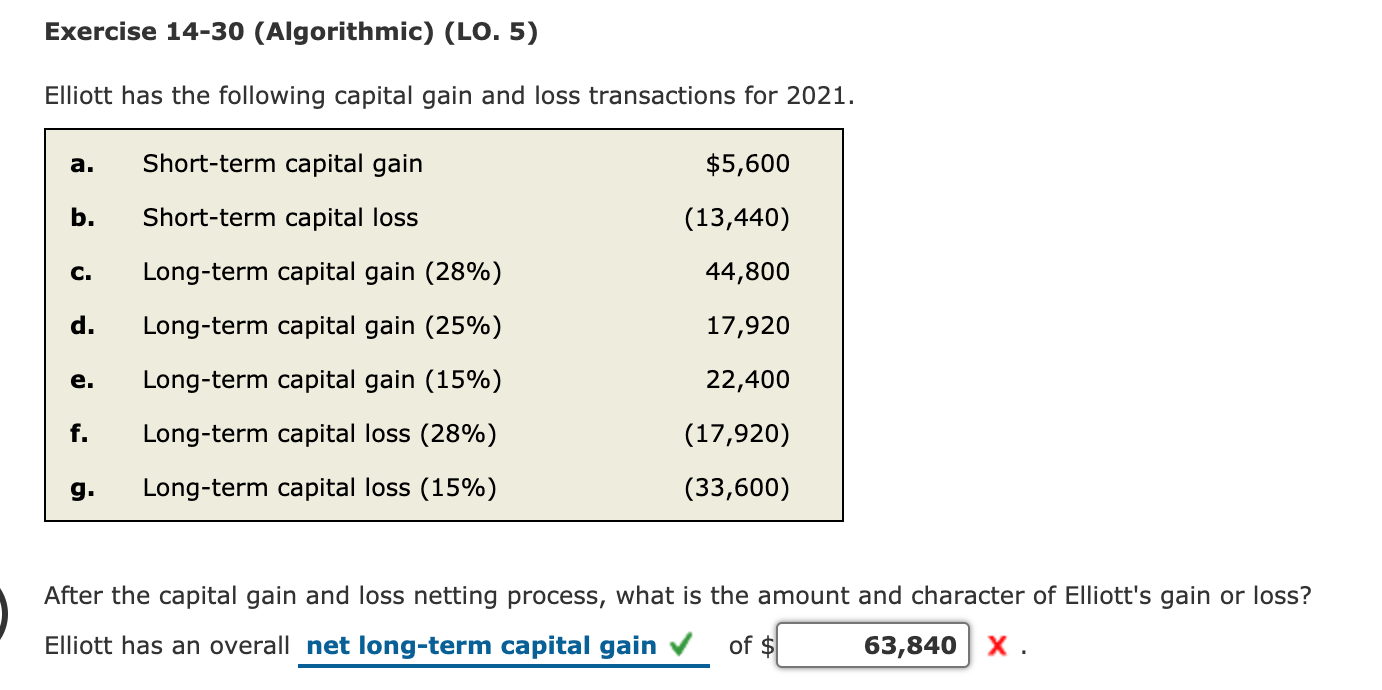

ITAT Upholds disallowance on account of Failure to prove Long Term Capital Loss arises from Sale of Share Of Company